Tax free earnings when you invest in growing British businesses

You choose the entrepreneurs you back and you can potentially earn 6% - 15% tax free.

Register nowYou choose the entrepreneurs you back and you can potentially earn 6% - 15% tax free.

Register nowAs you know, Individual Savings Accounts (ISAs) are accounts for saving and investments that let you earn tax-free returns, up to £20,000.

The Innovative Finance ISA (IFISA) is new, and specifically developed for online lending. By investing in businesses with the IFISA, you can earn tax-free interest, up to £20 000. This new IFISA will enable you to include your Crowd2Fund investments within your £20 000 allowance, giving you all the advantages of ISAs, with the added benefits of Crowd2Fund; flexibility to choose the great British businesses you want to support.

Dan Rees, founder of Ruroc received £362k from 302 investors offering 10% return and a product discount on their new Atlas helmet design.

ISAs have long represented a reliable way to save and invest. Crowd2Fund offers great returns, flexibility and impeccable service, supported by our innovative technology.

You can shelter up to £20,000 of your Crowd2Fund investments from tax.

Earn an estimated 6-15% APR return on average tax free before fees and bad debt.

Support British entrepreneurs, grow the economy, and choose innovative to invest in.

Easily transfer your Old ISA to your Crowd2Fund account quickly and hassle free.

Access your capital by selling to others on the Exchange.

Use our Smart-Invest feature to manage your investing automatically.

The Exchange is a marketplace which allows investors to trade their Crowd2Fund investments.

Smart-Invest is an intelligent feature that helps you automatically invest your funds into opportunities.

We are a P2P lending company, building long-term relationships between investors and the great British businesses they invest in. Crowd2Fund is different from other lenders; as a sophisticated private investor, you choose which businesses you lend money to.

"You can see there are real people behind Crowd2Fund. We hope they are proud of what they helped us achieve. We raised £771,900 from more than 1283 investors, which wouldn’t be possible via high street banks.”

We were the first platform to offer the Innovative Finance ISA, and won the IF ISA 2018 Moneynet Awards ‘Best Innovative Finance ISA provider’.

We help entrepreneurs who have fast-growing, profitable, British businesses to take the next step. Businesses that have proven success, a social or ethical cause, or can offer rewards are best suited to Crowd2Fund.

Use this calculator to estimate your tax free earnings.

Estimated interest earned

Estimated tax savings

Estimated old ISA earnings

Crowd2Fund fees

Tax treatment of any of the investment offers will depend on the individual circumstances of each investor and you should speak to your advisor before making an investment. When making a peer to business loan, your capital lent to a borrower is not covered for compensation in the event of a loss by the Financial Services Compensation Scheme. This calculation is an estimate and actual returns may be higher or lower. This calculation is an estimate and actual returns may be higher or lower. It assumes that any reinvestments are re-invested immediately.

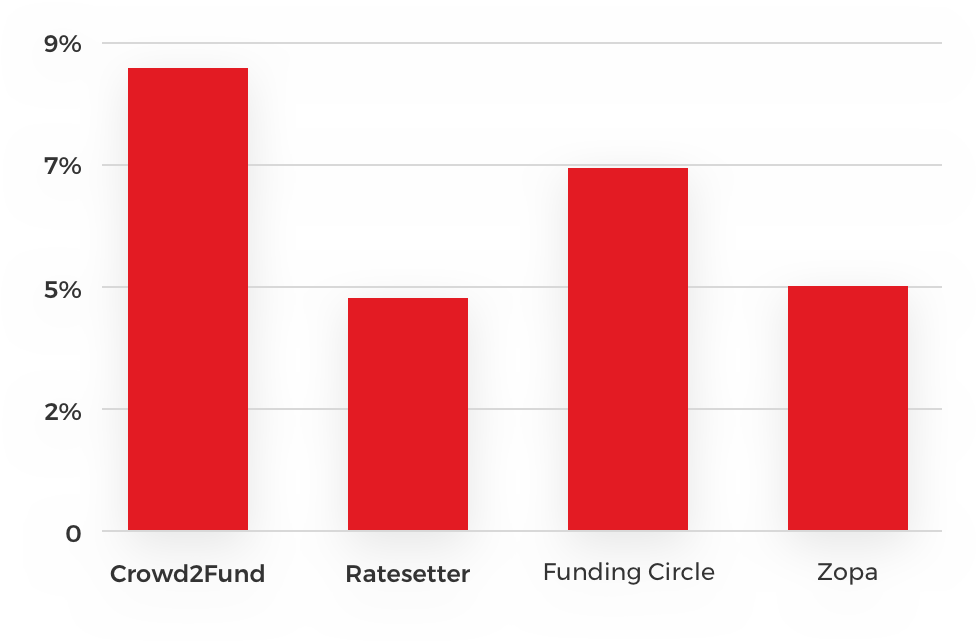

This is how Crowd2Fund compares with other platforms in the peer-to-business lending space.

Crowd2Fund is fully mobile responsive, working seamlessly on all handsets, with an iOS app too. As an investor, it’s easy to engage with the businesses and manage your portfolio. If you need any assistance, our investor support team is here to help

Registering your IFISA with Crowd2Fund is a simple process. .

Access your capital by selling to others on the Exchange.

Confirm your old ISA manager details. This may take up to 3 business days to transfer.

As an Investors, you choose exactly which business you want to back, and lend directly via the platform. You can also trade on the Exchange.

We built Crowd2Fund to be a community of entrepreneurs, and genuinely care about both the businesses and the investors who form that community. We’ve worked with 1000’s of small businesses and entrepreneurs, and we’re currently backed by more than 7500 experienced investors and successful entrepreneurs.

Investment team and support

If you’d like to transfer your cash ISA or stocks and shares ISA to Crowd2fund, please complete the Transfer Authority Form. The form can be downloaded from here, or by emailing info@crowd2fund.com. Once the completed form is received, we will liaise with investors previous ISA manager to transfer a Cash or Stock and Shares ISA to us. In case you change your mind, you’ll get 14 days cancellation rights. There is no fee for opening or transferring an ISA to us.

If you have multiple years worth of savings within your ISA you are able to transfer these and continue earning tax free on Crowd2Fund. There is no fee for setting up an IFISA on Crowd2Fund.

At Crowd2Fund, we want investors to get the most out of the platform, enabling them to get the best returns for their risk appetite

At Crowd2Fund, we want investors to get the most out of the platform, enabling them to get the best returns for their risk appetite.

Diversification is a fundamental strategy in P2P investing that helps to reduce exposure to risk.

The Exchange is our secondary market that provides a dynamic platform for investors to trade their investments.

We provide the tools and information on all opportunities for investors to perform their own due diligence

By reinvesting repayments, the investor will be earning interest on their repaid interest

The only platform of it’s kind, Crowd2Fund is built to support entrepreneurs. With our due diligence processes, dedicated support teams, cutting edge technology and 7,500 waiting to invest, we’d love to help you achieve your business goals.

Register now